Ways To Boost Up Your Credit Scores In No Time!!

Nowadays, everyone is concerned with their perceived image or reputation in the market. We do a lot of hard work to create our good image in people and sometimes due to intentional reasons it may come down. You must focus on your image not only in public but also in your own eyes. Once in a lifetime, we may face a shortage of funds due to several reasons. We need tech tips to come out of anything logically. When we face a shortage of funds the first thing that comes to our mind is borrowing from banks. Banks perform many transactions every day and they deal with deposits and lending money to people.

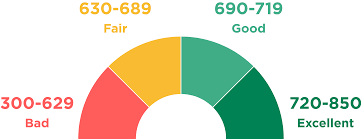

Even some so many people always need funds due to bankrupts or due to several other reasons. What do you think that banks lent money to all the person whosoever is coming to bank for loans, the answer is no. If the bank starts lending in this way, the whole bank will become bankrupt. There is a concept called credit score which is being checked by the banks of a person who is applying for loans. Many other conditions are to be fulfilled before sanctioning loans. Banks check your past payment history, your taken loans, frequency of your interest payments, etc before allowing loans.

If you are not aware of the concept of credit score you can check videos on YouTube relating to the same. One video by speaker Govind is there on YouTube which is very helpful and easy to understand the concept of credit score in simple words. You can also review your credit score with the help of the app mentioned in the video that is one score app. you can easily download this application from the internet and this app is very simple to use and not annoy you with unwanted texts. There are many tech ways in which you can focus on boosting your credit score. Some of the ideas or ways are:

- Checking your credit history: you must keep a check on your credit history and get your credit reports timely. You must assess that credit reports timely to avoid any kind of error or inaccuracy in the report.

- Focusing on your history of making payments: every day we come across so many payments to be made of daily routine. Sometimes we ignore paying them on time and wait for its last due date etc which will decrease your credit score eventually.

- amount of debt: it’s ok to take debt but you must repay it on time. You must comply with all the debt requirements or the payments to be made in the form of interest etc on time.

- Clear your dues or late payments: if you have enough cash or money then never late any kind of payments that you have to pay mandatory. Today or tomorrow you have to pay so doesn’t wait for deadlines. Try to clear all your dues standing in lieu of payments etc.

So, try to find, how to check cibil score with the help of one score app and know your credit scores in no time.